1. LEARN

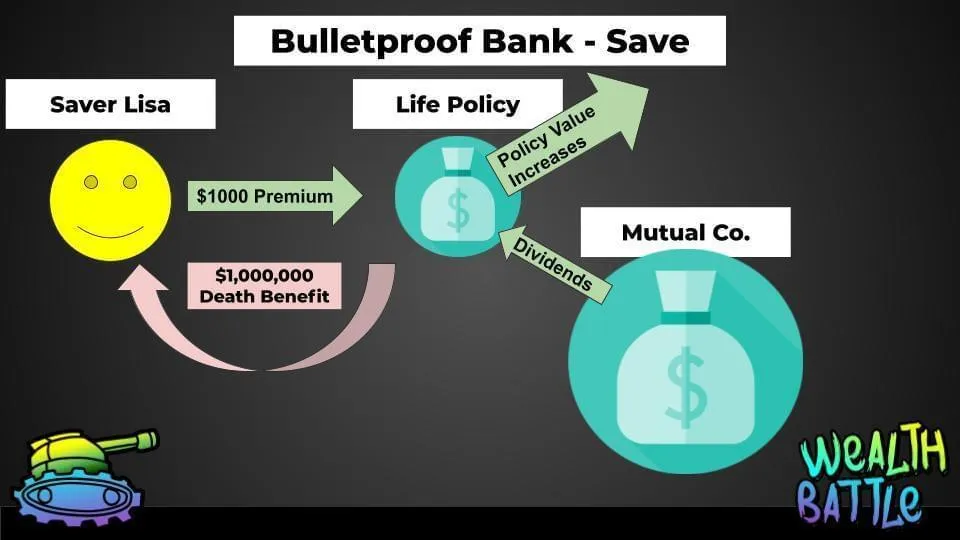

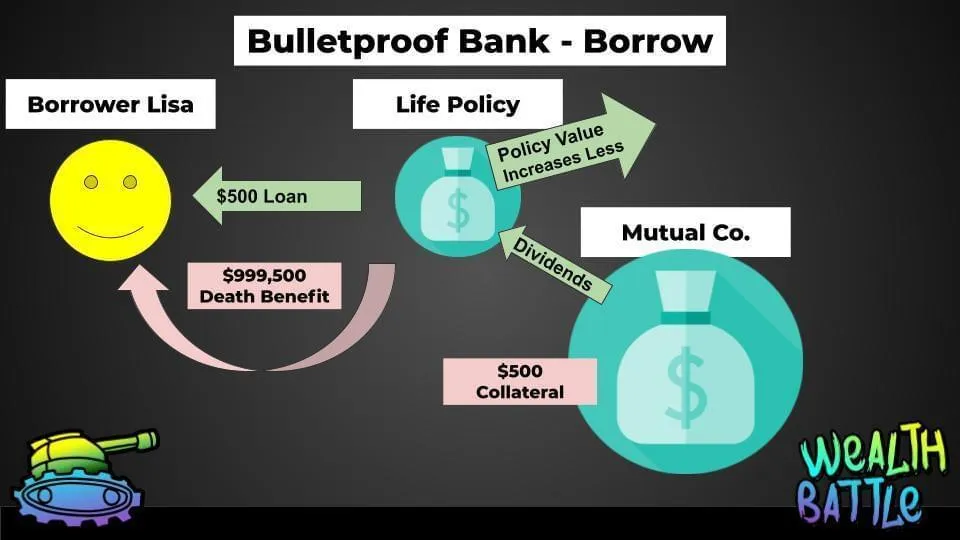

How Bulletproof Banking helps you grow, protect, and use your money more efficiently!

2. DESIGN

Your Bulletproof Bank.

Discover how much easier your future will be with a Bulletproof Bank in your financial battleplan.

3. EXPAND

Your Opportunity Funds & Your Mind. Join a Bulletproof Brigade!

Estate PlanninG

very technical concepts

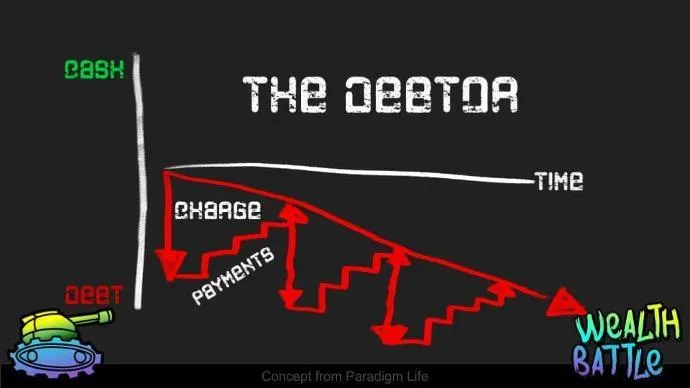

THE DEBTOR

Charges add to debt load - accruing interest, increasing debt loads, and expanding the gap from wealth accumulation.

The Debtor is Overleveraged.

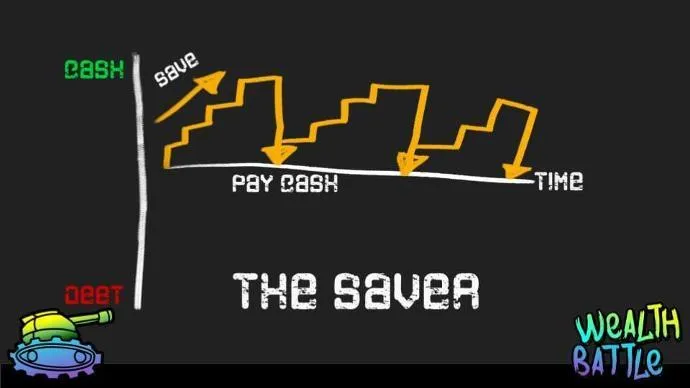

THE SAVER

Save/Spend resets wealth. The opportunity cost of deploying cash leads to suboptimal accumulation of wealth.

The Saver is Underleveraged.

THE WEALTH BATTLER

There are a ton of questions around Estate Planning in the USA that normally you'd have to pay a lawyer big bucks to answer.

What happens to my stuff when I 💀?

What is Estate Planning?

What is Probate?

How do wills and trusts differ?

What the heck is a revocable living trust?

Watch the free webinar on this page or read on.

WealthBattle.com can create your estate plan.

Watch the free webinar above

Create your estate plan

Don't leave life's most important decisions to the State

Schedule a call. Create your estate plan.

Estate PlanninG Information

Why have an estate plan?

Estate planning is a way to ensure your assets are distributed according to your wishes after you die or become incapacitated and that your loved ones won't be faced with complications or conflicts.

Estates commonly include:

Revocable Trust

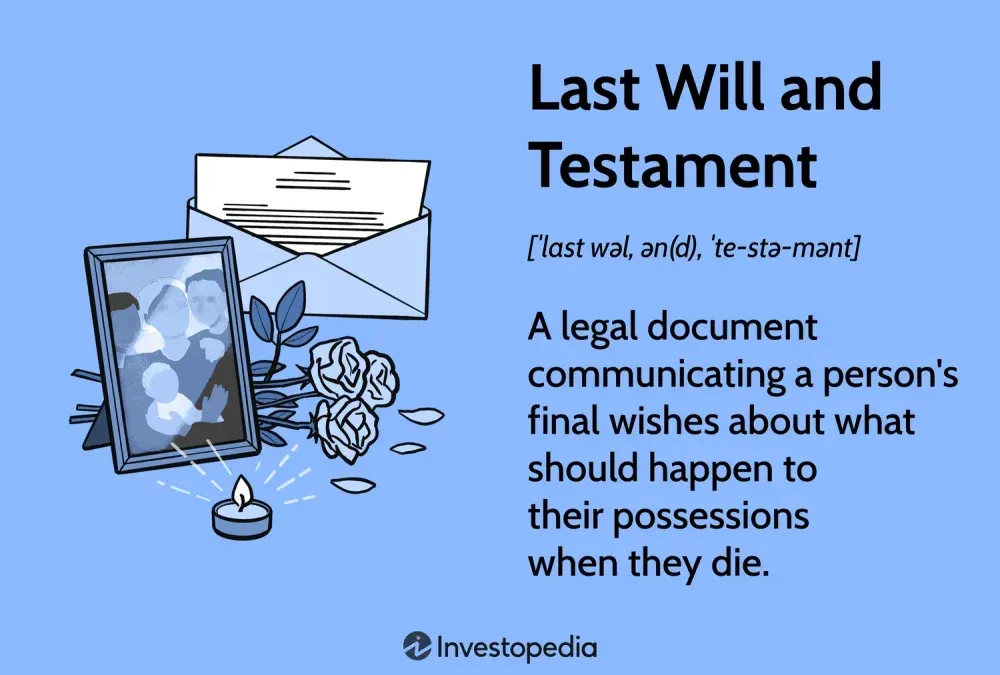

Last Will and Testament

Financial Powers of Attorney

Healthcare Powers of Attorney

What is probate?

the legal procedure where assets are formally passed to beneficiaries after death.

It is:

time-consuming

delays passing your assets

very expensive

public record

And most importantly....completely avoidable

Goal for your assets: avoid probate

What about wills?

Believe it or not....

You HAVE a will now!

It was drafted for you at birth by the State.

If YOU would like choose what happens to your things upon death or incapacitation, and not leave it up to the state, continue on...

Your Will

A Last Will & Testament is a legal document that outlines the wishes for the administration and division of an estate after passing.

It can also serve to assign legal guardianship over minors and wishes for pets.

A Will does not avoid probate.

Assets owned in a deceased person's name with no named beneficiary are no longer accessible once the asset owner dies. A petition must be filed with the probate court to move forward. Insert delays, fees, and permission from the courts.

So how do we avoid probate and get our stuff to who we want to when we die??

Enter the TRUST.

Revocable Living Trust

legally binding instrument that allows a third party, or trustee, to hold assets on behalf of a beneficiary.

It is a legal document used for avoiding probate

and minimizing estate taxes.

Assets owned in the name of a Trust are immediately accessible to the trust maker's designated successor.

A Trust also provides:

Privacy

Creditor Protection

Special Needs Protection

Potentially Reduced Estate Taxes

Assets for Minor Children

Special Provisions

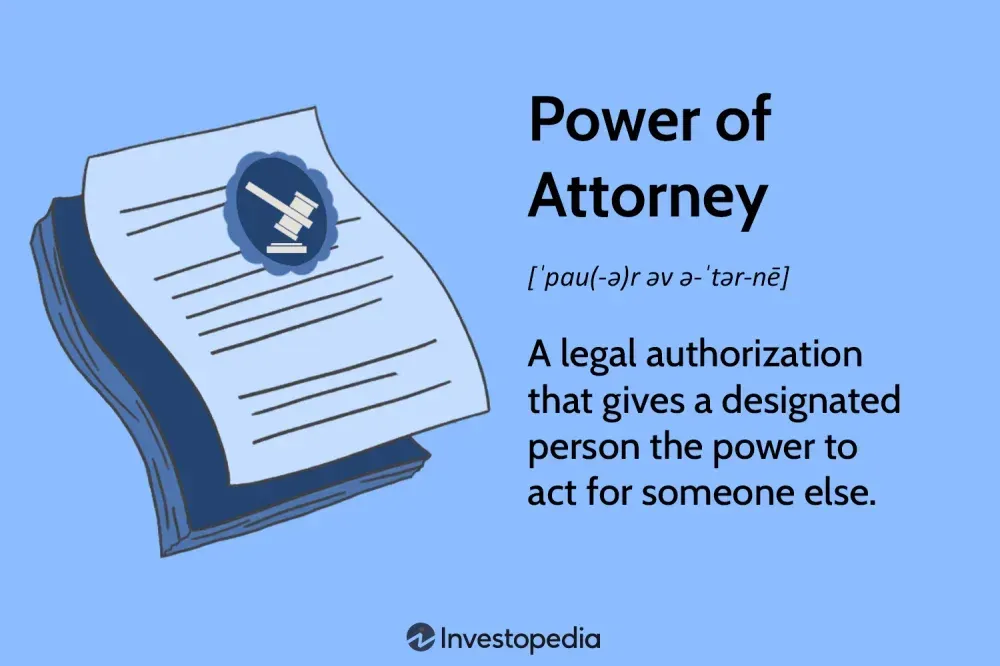

Power of Attorney is very important if you are unable to act on your own behalf. Choose who you want to make important decisions in your life on your behalf.

There are two major flavors of Power of Attorney

Financial and Healthcare

Financial Power of Attorney

Potential responsibilities:

pay bills

make investment decisions

conduct real estate transactions

file taxes

other financial management needs

The financial power of attorney may be compensated

Note: Your agent acting under a power of attorney has no control over decisions involving assets owned by your trust.

The trustee of your trust manages assets owned by the trust. Your agent does not have testamentary powers either. They cannot sign new documents into being on your behalf, nor make changes to your qualified accounts.

Healthcare Power of Attorney

Responsible for making healthcare decisions for you if you become unable to do so yourself.

State laws vary regarding the specific allowances for a healthcare power of attorney.

Generally they can agree to, refuse, or withdraw treatment on your behalf.

Communicate your wishes clearly to this trusted person and consider including details about your medial wishes in your final letter of instruction.

Create your estate plan

Don't leave life's most important decisions to the State

Schedule a call. Create your estate plan.

Ready to take control of your estate?

Avoid probate

Prevent delays

Keep your privacy

Don't pay unnecessary fees

Choose who gets what from your estate

Let's design your personalized bulletproof policy!

Opportunity Funds are crucial to financial resilience. Without a reserve to draw upon, you are vulnerable to the next wave of chaos brought in by life.

unsure of your numbers?

Overhaul your budget before opening the Bulletproof Bank and maximize your financial strategy.

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn't, pays it.

~ Attributed to Albert Einstein