BULLETPROOF BANKING

How Bulletproof Banking helps you grow, protect, and use your money more efficiently!

Your Bulletproof Bank.

Discover how much easier your future will be with a Bulletproof Bank in your financial battleplan.

Your Opportunity Funds & Your Mind. Join a Bulletproof Brigade!

1. LEARN

How Bulletproof Banking helps you grow, protect, and use your money more efficiently!

2. DESIGN

Your Bulletproof Bank.

Discover how much easier your future will be with a Bulletproof Bank in your financial battleplan.

3. EXPAND

Your Opportunity Funds & Your Mind. Join a Bulletproof Brigade!

very technical concepts

very technical concepts

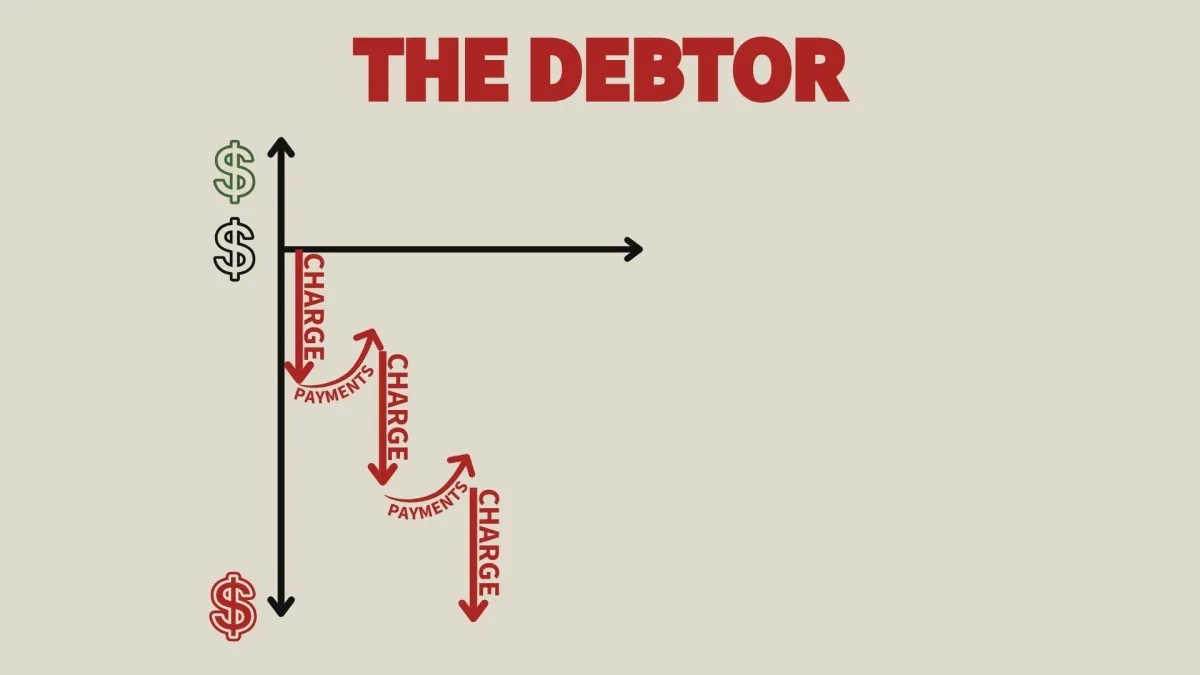

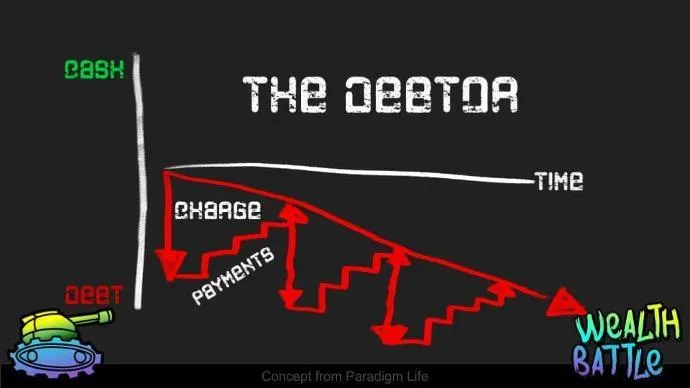

Charges add to debt load - accruing interest, increasing debt loads, and expanding the gap from wealth accumulation.

The Debtor is Overleveraged.

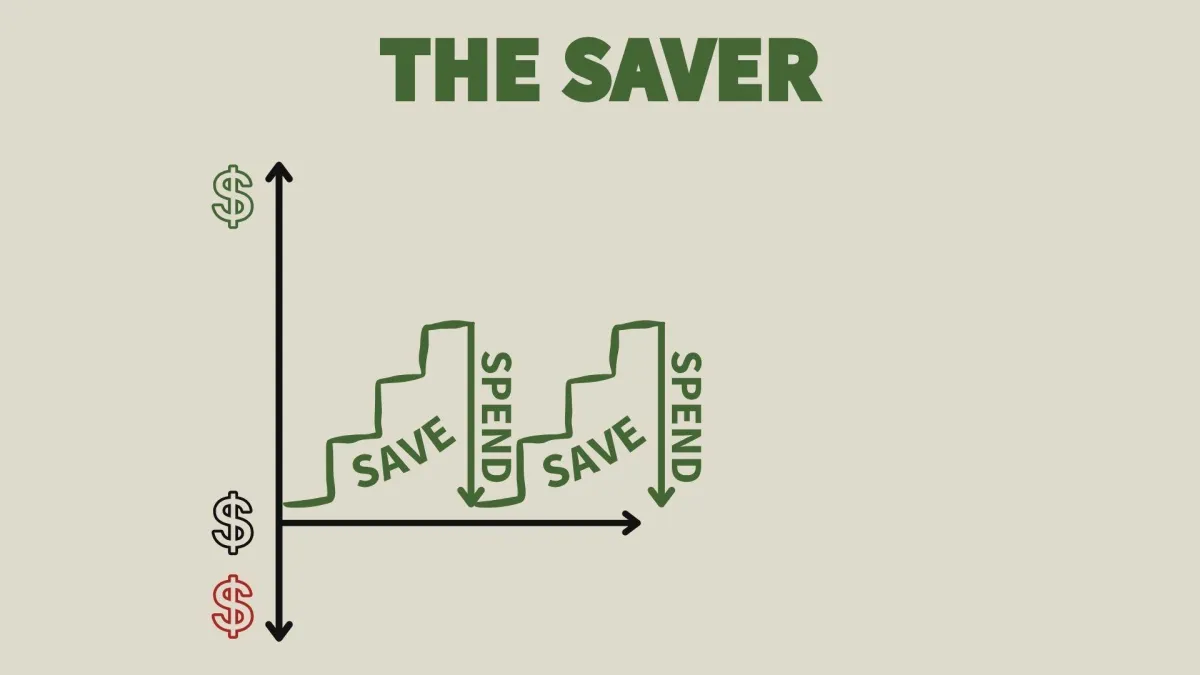

Save/Spend resets wealth. The opportunity cost of deploying cash leads to suboptimal accumulation of wealth.

The Saver is Underleveraged.

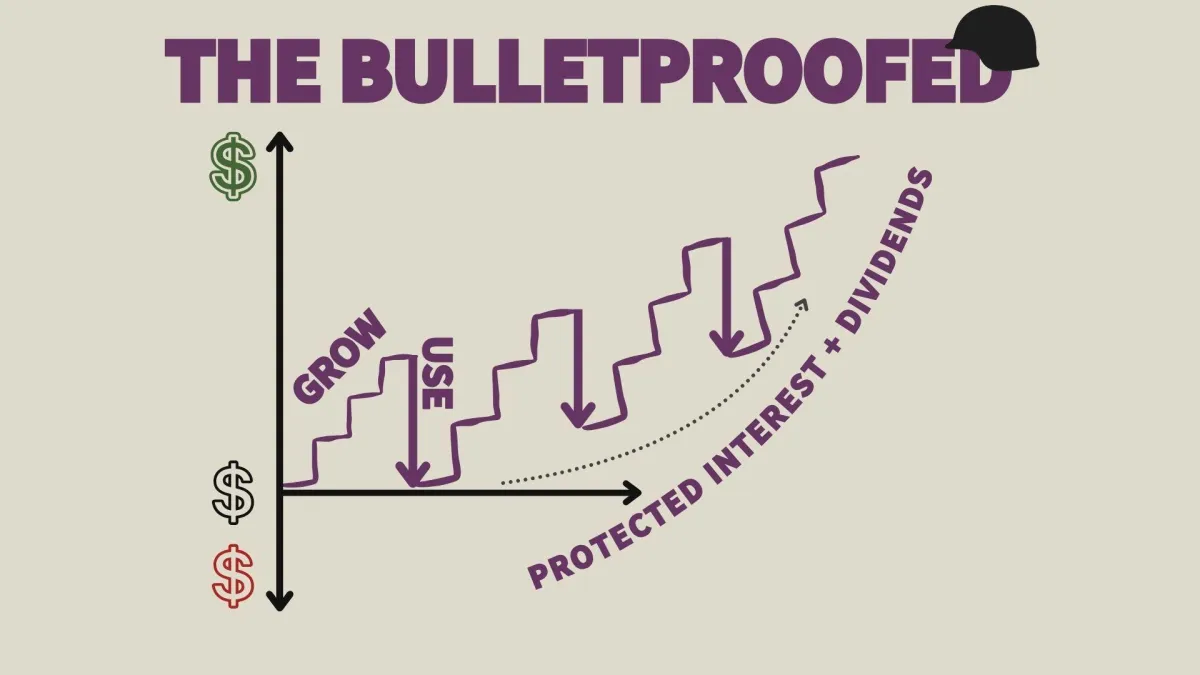

The Bulletproofed leverages Bulletproof Banking principles to Grow, Protect & Use opportunity funds.

The Wealth Battler is Properly Leveraged.

THE DEBTOR

Charges add to debt load - accruing interest, increasing debt loads, and expanding the gap from wealth accumulation.

The Debtor is Overleveraged.

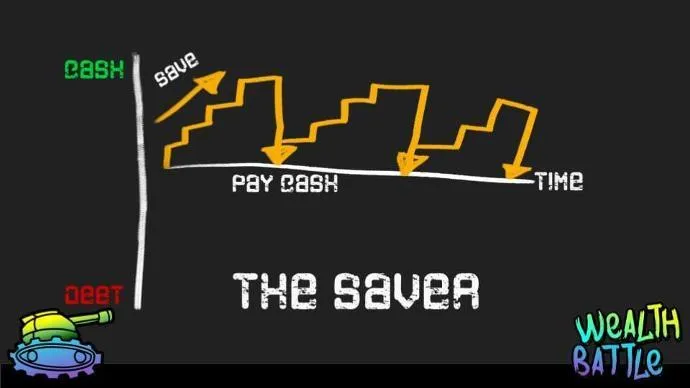

THE SAVER

Save/Spend resets wealth. The opportunity cost of deploying cash leads to suboptimal accumulation of wealth.

The Saver is Underleveraged.

THE WEALTH BATTLER

With Optimized Strategies, a Wealth Battler leverages Bulletproof Banking principles to Grow, Protect & Use opportunity funds.

The Wealth Battler is Properly Leveraged.

Let's design your personalized bulletproof policy!

Let's design your personalized bulletproof policy!

Opportunity Funds are crucial to financial resilience. Without a reserve to draw upon, you are vulnerable to the next wave of chaos brought in by life.

Opportunity Funds are crucial to financial resilience. Without a reserve to draw upon, you are vulnerable to the next wave of chaos brought in by life.

unsure of your numbers?

Overhaul your budget before opening the Bulletproof Bank and maximize your financial strategy.

unsure of your numbers?

Overhaul your budget before opening the Bulletproof Bank and maximize your financial strategy.

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn't, pays it.

~ Attributed to Albert Einstein

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn't, pays it.

~ Attributed to Albert Einstein

What is an Opportunity Fund?

An Opportunity is a place to: Grow, Protect, and Use your savings before and during the purchase of an Asset.

You could keep a bunch of cash under your mattress. As the stash increases, you lose more and more purchasing power over time. Holding cash can result in losses equal to or in excess of your earning potential. OOF.

Wealth Battlers prefer to leverage Whole Life Insurance to build their opportunity funds. We call this strategy "Bulletproof Banking." Whole life insurance policies offer a guaranteed growth rate and dividend payments. This guarantees that your cash value will grow over time unlike cash losing value due to inflation or stocks exposed to market risks and manipulations from government policies.

Why Bulletproof Banking?

Bulletproof Banking allows you to purchase an asset and have a guaranteed yield in a tax free environment.

How does Bulletproof Banking work?

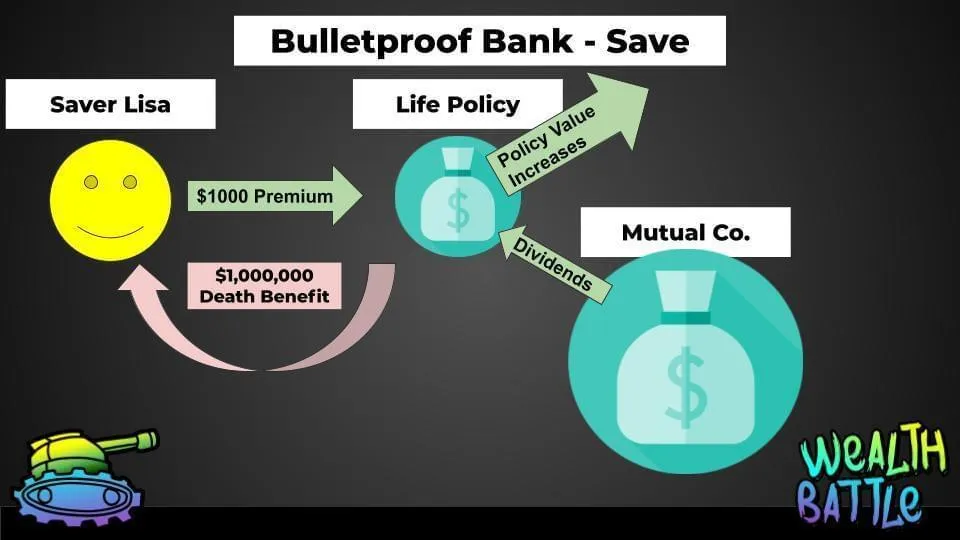

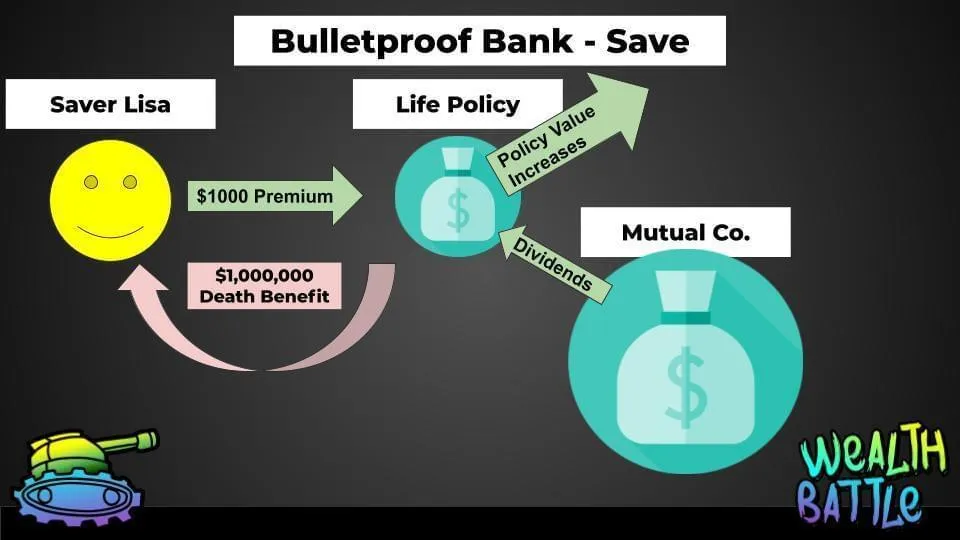

As you contribute premium into the whole life insurance policy it accumulates cash value, with guaranteed growth, that you can borrow against at any point. In addition, mutual company policy holders can also earn tax-free dividends annually if they keep their policies in force.

How does this affect taxes?

In a word... Wonderfully. Taxation is theft and bulletproof banking shields a portion of your wealth from the grips of the government.

The Bulletproof Banking strategy allows you to borrow against the cash value of your whole life insurance policy. These policy loans are tax-free. While you have a policy loan out, your account value doesn't go down, it continues to grow with interest and dividends!

This is a more tax-efficient way to access funds compared to cashing out stocks and paying capital gains taxes... Or if you were unfortunate enough to be suckered into a 401(k) plan, paying higher ordinary income taxes on what would have been lower capital gains taxes.

What if I'm in a lawsuit?

Bulletproof Banking done right provides protection against creditors and legal action. It provides a safe haven for funds that might otherwise be exposed to loss. In contrast, cash holdings, stocks, retirement accounts may not have the same level of protection.

Why borrow my own money?

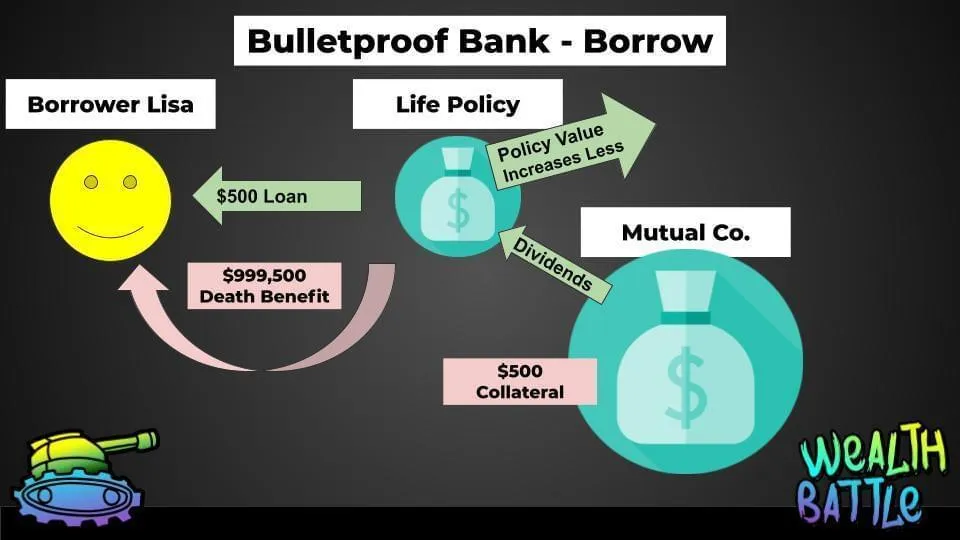

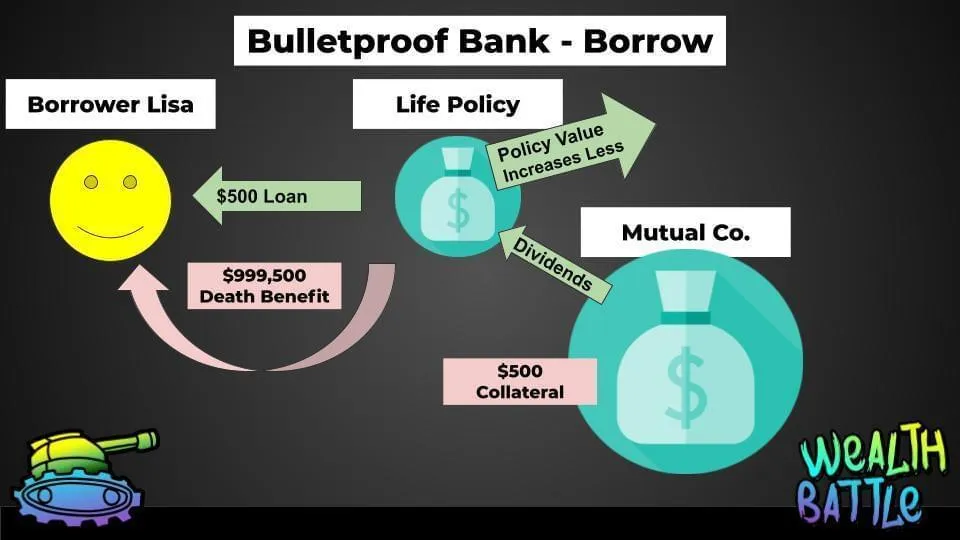

When you take a policy loan in bulletproof banking, the insurance company writes you a check from their general fund. In return, they get collateral against your death benefit. When your policy matures (you die), any money on loan plus any interest accrued will be deducted from the death benefit the insurance company is contractually obligated to pay to your beneficiary. This is different than the "stuff cash under my mattress" situation above where, you "own" the money.

But here's the truth, paying cash is financing. You lock your purchase into a single use of money.

Bulletproof Banking allows you to turn money from this OR that into this AND that, actually this AND that AND that.

You can go on vacation AND have that money growing in the background AND leave legacy. You can start a business AND collect dividends on the investment you put into your business AND protect your family.

When I borrow, how much do I pay per month?

Most people think of loans with terms like a car loan or a home mortgage. If I borrow $10,000 - I must pay back X dollars per month for Y years or else something bad would happen to me.

In bulletproof banking, there are no repayment terms. You can pay back the policy loan on your own schedule, unlike traditional loans which require a set monthly payment.

You can set your own terms or repayment with yourself. You can base it on a percentage of new business, kick the can down the road while you wait for something to pay off big - it's completely your decision.

How do you get paid?

The insurance companies pay a commission for writing a policy; however, most agents won't write these policies unless someone is able to start with tens of thousands per year in their bank because the commissions are pretty low relative to other products like Indexed Universal Life (of TikTok fame).

That's why we have structured WealthBattle.com around a subscription model. It allows us to continually support people, have regular meetings, and answer questions real-time as life grows and changes rather than saddling you with a policy that you don't know how to use and saying 'Good Luck'.

For comparison, we welcome people who have policies with other insurance agents and companies to bring their questions to WealthBattle.com - because we will cut to the math and logic behind a given strategy. Most agents want to write as much volume as possible and send their clients into the world woefully underprepared with little (if any) support. We believe that it's important to stand by our community and support you, whether your bulletproof bank is $1,200 or $200,000+.

What about Indexed Universal Life?

There are a few flavors of permanent insurance that are not WHOLE LIFE that we espouse. Most of the IUL or other policies do not have

IUL does not have Guaranteed premiums, so your costs could go up over time, like DOUBLE or TRIPLE! Where you have to cancel the policy.

Bulletproof Banking with Whole Life has a guaranteed, fixed premium for your whole life. No surprises, the cost never goes up, in fact we often can structure the payment to go down in older age to maximize tax free money as a retirement supplement!

IUL does not have Guaranteed Growth, because it's indexed to the market, you may have higher or lower rates of return than what is on the illustration. Anytime someone counts on the market's average return vs the actual return, they are not hip to the math of retirement and likely have been taken in as a stooge in the wall-street casino.

Bulletproof Banking with Whole Life has contractually guaranteed returns and has delivered dividends for over 150 years! What this means for you is that your money will grow in the background while you protect it from market losses, taxes, and legal judgements while you can use it to grow a business, buy a house, purchase a car, and so much more!

Bulletproof Banking has guaranteed fix premiums, guaranteed cash value, and guaranteed death benefit.

How do I get a loan from my bank?

Follow the instructions on a policy loan doc from your contract.

If you have written a policy with Penn you can download that form by clicking here: "DOWNLOAD FORM".

If you print, sign, and scan the document you can e-mail [email protected] rather than mailing or faxing.

I have my bulletproof bank - what if I still have questions?

Join a Bulletproof Brigade meeting on the WealthBattle Discord Server - a small group that meets on the 2nd Tuesday of every month @ 8P Eastern.

Bulletproof Brigades are small group meetings designed to promote these 3 things with YOUR BANK:

Growth of funds

Protection of principal

Using funds along the way

It's included as a part of your subscription to WealthBattle.com.

Need a private conversation to go over something specific? Click here: SCHEDULE MEETING.

What is an Opportunity Fund?

An Opportunity is a place to: Grow, Protect, and Use your savings before and during the purchase of an Asset.

You could keep a bunch of cash under your mattress. As the stash increases, you lose more and more purchasing power over time. Holding cash can result in losses equal to or in excess of your earning potential. OOF.

Wealth Battlers prefer to leverage Whole Life Insurance to build their opportunity funds. We call this strategy "Bulletproof Banking." Whole life insurance policies offer a guaranteed growth rate and dividend payments. This guarantees that your cash value will grow over time unlike cash losing value due to inflation or stocks exposed to market risks and manipulations from government policies.

Why Bulletproof Banking?

Bulletproof Banking allows you to purchase an asset and have a guaranteed yield in a tax free environment.

How does Bulletproof Banking work?

As you contribute premium into the whole life insurance policy it accumulates cash value, with guaranteed growth, that you can borrow against at any point. In addition, mutual company policy holders can also earn tax-free dividends annually if they keep their policies in force.

How does this affect taxes?

In a word... Wonderfully. Taxation is theft and bulletproof banking shields a portion of your wealth from the grips of the government.

The Bulletproof Banking strategy allows you to borrow against the cash value of your whole life insurance policy. These policy loans are tax-free. While you have a policy loan out, your account value doesn't go down, it continues to grow with interest and dividends!

This is a more tax-efficient way to access funds compared to cashing out stocks and paying capital gains taxes... Or if you were unfortunate enough to be suckered into a 401(k) plan, paying higher ordinary income taxes on what would have been lower capital gains taxes.

What if I'm in a lawsuit?

Bulletproof Banking done right provides protection against creditors and legal action. It provides a safe haven for funds that might otherwise be exposed to loss. In contrast, cash holdings, stocks, retirement accounts may not have the same level of protection.

Why borrow my own money?

When you take a policy loan in bulletproof banking, the insurance company writes you a check from their general fund. In return, they get collateral against your death benefit. When your policy matures (you die), any money on loan plus any interest accrued will be deducted from the death benefit the insurance company is contractually obligated to pay to your beneficiary. This is different than the "stuff cash under my mattress" situation above where, you "own" the money.

But here's the truth, paying cash is financing. You lock your purchase into a single use of money.

Bulletproof Banking allows you to turn money from this OR that into this AND that, actually this AND that AND that.

You can go on vacation AND have that money growing in the background AND leave legacy. You can start a business AND collect dividends on the investment you put into your business AND protect your family.

When I borrow, how much do I pay per month?

Most people think of loans with terms like a car loan or a home mortgage. If I borrow $10,000 - I must pay back X dollars per month for Y years or else something bad would happen to me.

In bulletproof banking, there are no repayment terms. You can pay back the policy loan on your own schedule, unlike traditional loans which require a set monthly payment.

You can set your own terms or repayment with yourself. You can base it on a percentage of new business, kick the can down the road while you wait for something to pay off big - it's completely your decision.

How do you get paid?

The insurance companies pay a commission for writing a policy; however, most agents won't write these policies unless someone is able to start with tens of thousands per year in their bank because the commissions are pretty low relative to other products like Indexed Universal Life (of TikTok fame).

That's why we have structured WealthBattle.com around a subscription model. It allows us to continually support people, have regular meetings, and answer questions real-time as life grows and changes rather than saddling you with a policy that you don't know how to use and saying 'Good Luck'.

For comparison, we welcome people who have policies with other insurance agents and companies to bring their questions to WealthBattle.com - because we will cut to the math and logic behind a given strategy. Most agents want to write as much volume as possible and send their clients into the world woefully underprepared with little (if any) support. We believe that it's important to stand by our community and support you, whether your bulletproof bank is $1,200 or $200,000+.

What about Indexed Universal Life?

There are a few flavors of permanent insurance that are not WHOLE LIFE that we espouse. Most of the IUL or other policies do not have

IUL does not have Guaranteed premiums, so your costs could go up over time, like DOUBLE or TRIPLE! Where you have to cancel the policy.

Bulletproof Banking with Whole Life has a guaranteed, fixed premium for your whole life. No surprises, the cost never goes up, in fact we often can structure the payment to go down in older age to maximize tax free money as a retirement supplement!

IUL does not have Guaranteed Growth, because it's indexed to the market, you may have higher or lower rates of return than what is on the illustration. Anytime someone counts on the market's average return vs the actual return, they are not hip to the math of retirement and likely have been taken in as a stooge in the wall-street casino.

Bulletproof Banking with Whole Life has contractually guaranteed returns and has delivered dividends for over 150 years! What this means for you is that your money will grow in the background while you protect it from market losses, taxes, and legal judgements while you can use it to grow a business, buy a house, purchase a car, and so much more!

Bulletproof Banking has guaranteed fix premiums, guaranteed cash value, and guaranteed death benefit.

How do I get a loan from my bank?

Follow the instructions on a policy loan doc from your contract.

If you have written a policy with Penn you can download that form by clicking here --> "DOWNLOAD FORM"

If you print, sign, and scan the document you can e-mail [email protected] rather than mailing or faxing.

I have my bulletproof bank - what if I still have questions?

Join a Bulletproof Brigade meeting on the WealthBattle Discord Server - a small group that meets on the 2nd Tuesday of every month @ 8P Eastern.

Bulletproof Brigades are small group meetings designed to promote these 3 things with YOUR BANK:

Growth of funds

Protection of principal

Using funds along the way

It's included as a part of your subscription to WealthBattle.com.

Need a private conversation to go over something specific? Click here --> "SCHEDULE MEETING"